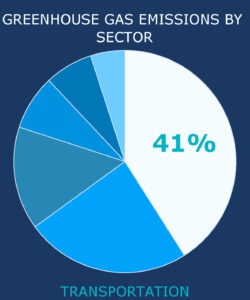

Public transit is critical to curbing greenhouse gas emissions. The reduction of driving from public transit can eliminate the equivalent of carbon dioxide emissions annually from generating electricity for 4.9 million households.

How California Can Increase Investments in Public Transportation

As traffic worsens, investments in public transit will become even more critical. Transit saves citizens time, stress, and money, while improving property values, creating jobs, and stimulating economic development. Even with needed improvements to the fuel economy and carbon content of fuel, transit will continue to be necessary to fight pollution and climate change. Current levels of funding for public transit, however, are insufficient to support the extensive system needed to achieve these economic and environmental benefits.

Public transit is critical to curbing greenhouse gas emissions. The reduction of driving from public transit can eliminate the equivalent of carbon dioxide emissions annually from generating electricity for 4.9 million households.

Public transit investments benefit residents by creating economic activity and job growth. One billion dollars in public transit investments is estimated to create 47,500 jobs, while each dollar in investment generates approximately six dollars in local economic activity.

Public transit encourages more sustainable land use development. Transit can shape land use patterns where residents live within walking distance of key services and mass transit and where neighborhoods contain a compact mix of uses, such as housing, offices, and retail.

Propose a voter initiative to lower the approval threshold for transit-related taxes, fees, and bonds.

The initiative should reduce the supermajority requirement to 55 percent for transit-related revenue measures with built-in accountability measures to prevent waste.

Develop a regional tax-increment financing program for transit.

The state should authorize local governments or regional entities to develop tax increment financing for transit. Tax increment financing allows local governments to issue bonds to be repaid by future increases in property tax revenues in order to finance public investments in infrastructure and transit. These investments in turn boost property values, which increase tax revenues in order to pay back the bondholders.

Develop proposals for property tax assessments or property-based fees to fund transit that include pre-paid transit passes.

New property tax assessments or other mechanisms to finance transit that are subject to voter approval may avoid the supermajority requirement of Proposition 26 (a ballot initiative approved by the voters in 2010 that imposes a two-thirds voter approval requirement for many charges) by offering pre-paid transit passes to assessed households in order to confer a specific benefit to the individuals paying the levy.

Encourage the development of “transfer fees” to fund transit.

A transfer fee, which would be levied upon the passing of title to a property from one person or an entity to another, can support a dedicated fund that will finance transit service and improvement in a neighborhood.

Consider implementing new or revised taxes or fees on driving automobiles to fund transit.

Such measures could include the indexing of gas taxes (converting the tax to a percentage of overall gasoline sales rather than a fixed per-gallon charge), a tax on vehicle miles traveled, congestion pricing, or a new tax or fee on car rentals.

Leverage private sources of capital to finance the transit system.

Private employers have a strong stake in the mobility of their customers and employees. These employers may be willing to contribute financially to the existing transit system or integrate their private transit systems for employees with public ones.

Support efforts such as “America Fast Forward” to help local governments issue bonds backed by existing transit revenue streams.

Local jurisdictions with existing transit revenue streams can finance construction of new transit lines by borrowing against future revenues. In order to make the borrowing cost-effective, the federal government will have to provide financial support to minimize or eliminate the interest on the bond payments that will be repaid from the sales tax revenue.

Implement variable pricing for parking and issue bonds secured by future parking revenue to finance transit improvements.

Variable pricing for parking (through meters that accept credit cards and adjust prices to reflect demand and minimize competition among drivers for spaces) generates revenue that local government leaders can use to finance transit, thereby improving neighborhoods and boosting sales and property values.

Collect data from existing sources documenting the economic and environmental benefits of transit investments.

Elected officials and the public will want hard data on the benefits that transit brings. Much of the data is already available in sources like the United States census and the regional transportation plans that each metropolitan region must submit under federal law.

Promote the data to the public and elected officials through coordinated marketing campaigns.

Coordinate the campaign with business and labor leaders who have stake in the expansion of transit for their employees and members and emphasize the economic development, environmental, and quality-of-life benefits of transit.

Prioritize cost-effective policies to ensure that existing transit systems operate efficiently and that planned systems are built without delay and cost overruns.

As part of the effort to promote transit benefits to the public, transit officials must ensure that existing service improves its efficiency by lowering costs and by employing dynamic means of providing services such as improving the use of global positioning devices (GPS) and wireless technologies and developing partnerships with private businesses interested in providing better commute options for their employees.

Condition future transit spending on improved local station area development.

Transit officials should direct agency spending for transit first to communities that allow more high-density, pedestrian-oriented development around station areas.

Target existing infrastructure and planning resources to jurisdictions willing to maximize station-area land use potential.

State resources for local government planning, such as through the Strategic Growth Council, state Department of Transportation (Caltrans), and the California Energy Commission (which has some funds available for energy-efficient planning), should be targeted at transit-friendly planning.

Ensure state transit funding is directed primarily to jurisdictions with supportive land use policies.

The state should follow the lead of the Metropolitan Transportation Commission and dedicate its transit resources to cities and counties willing to develop supportive land use for transit. Without these incentives, local governments are likely to preserve the status quo instead of developing community-supported visions for efficient and desirable growth in the community.

Provide tax credits and subsidies to employees who locate within walking, biking, or transit distance of their work.

Employees who choose to live close to work or take transit should be rewarded with mortgage interest tax credits or other assistance to stimulate demand for transit adjacent, mixed-use housing. Location-efficient mortgages represent one policy option, which allow transit-using homeowners to receive a higher and subsidized mortgage under the assumption of saved transportation costs.

The majority of costs for people is the maintenance and ownership of an automobile. Even if they bought cars and kept them in a garage to take transit, they’ll still be paying for the car. Better transit service provides the tipping point.

Scott Bernstein, Center for Neighborhood Technology